Dear Investor,

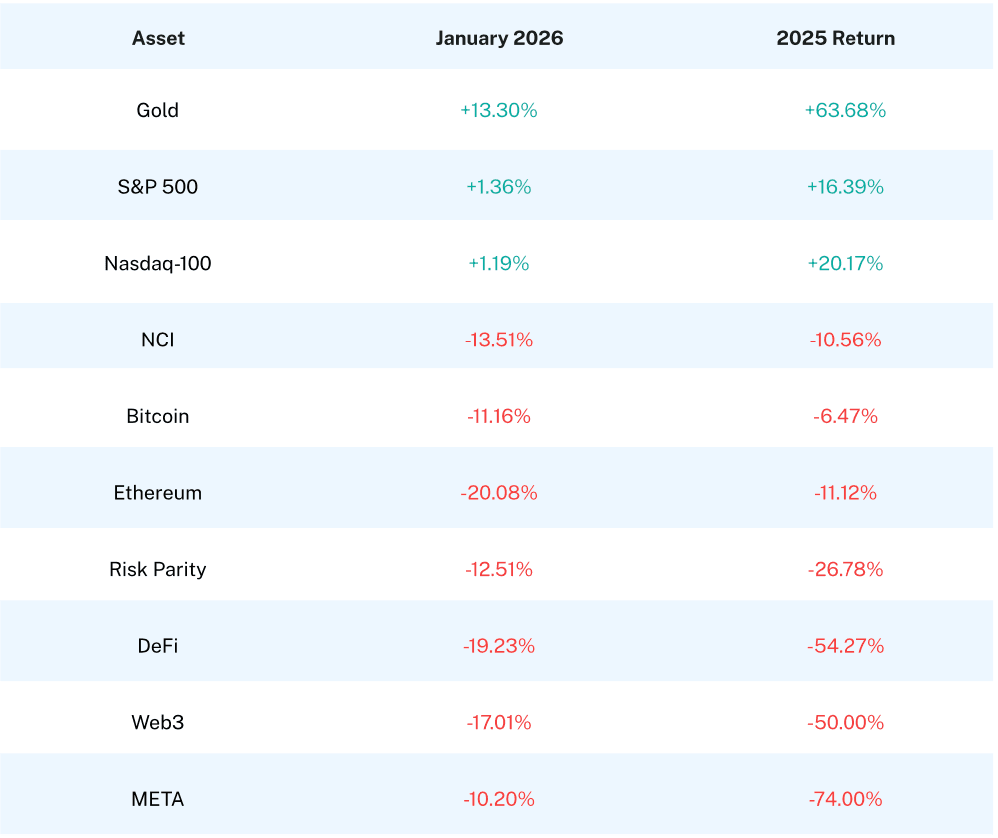

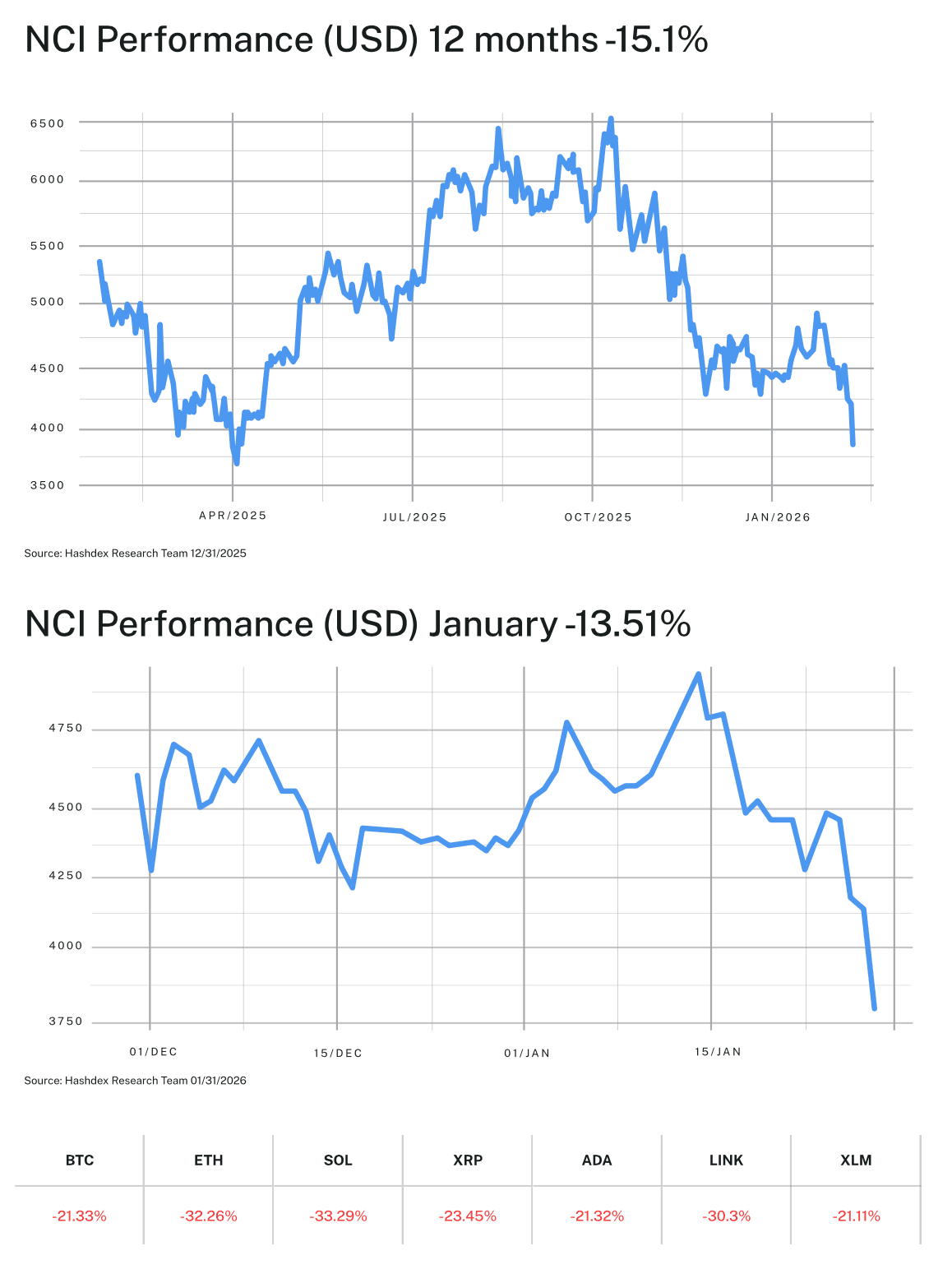

The new year started off rocky for crypto assets, with the Nasdaq CME CryptoTM Index (NCITM) declining 13.51% while stock market indices ended the month in positive territory and gold closed the month up double digits.

The underperformance of bitcoin relative to gold has drawn attention to the current “debasement trade” and the role of bitcoin as a store of value asset. Our CIO Samir Kerbage wrote about this topic, and what it means for crypto investors, in a recent article.

If you’re curious what the recent performance means for crypto’s long-term investment case, please join our team on February 19 for a webinar hosted by the Investments & Wealth Institute. You can register for the webinar here.

As always, we are greatly appreciative of your trust in us and are here to answer any questions you may have.

-Your Partners at Hashdex

Market Review

January opened the year with a stark reminder of crypto's evolving relationship with traditional safe havens. While gold surged 13.30%—its strongest January in decades—the Nasdaq CME CryptoTM Index (NCITM) declined 13.51%, extending 2025's losses into the new year.

The month's volatility centered on geopolitical drama that rattled markets globally. President Trump's January 18 threat of 10% tariffs on eight European countries over Greenland triggered the worst single-day selloff since October 2025—the S&P 500 dropped over 2% on January 20. Yet by January 21, Trump walked back the threats after meeting NATO Secretary-General Mark Rutte at Davos, claiming a "framework of a deal." Wall Street traders bet that tariff threats would remain rhetorical and traditional markets stabilized, with the S&P 500 ending January up 1.36% and the Nasdaq-100 gaining 1.19%.

Crypto markets found no such relief. Bitcoin (BTC) declined 11.16% for the month, while Ethereum fell 20.08%, as altcoin weakness persisted. The contrast with gold proved stark: while BTC struggled to reclaim $100,000, gold broke above $5,000 for the first time on January 23 before surging to $5,110 on January 26. Silver joined the rally, breaking $100 per ounce for the first time in history—both precious metals trading at levels unimaginable just two years ago.

Beyond tariff drama, an unprecedented threat to Federal Reserve independence captured market attention. The Justice Department opened an investigation into Fed Chair Jerome Powell, ostensibly centered on the Fed's headquarters renovation project but Powell called it "blatant political pressure" while bipartisan support emerged among former Fed chairs and lawmakers. On January 21, the Supreme Court heard arguments in Trump v. Cook regarding the president's power to fire Fed governors—justices appeared skeptical of the administration's position. These developments added another layer of uncertainty that benefited traditional safe havens over crypto assets.

Thematic indices continued their struggles. The Smart Contract Platform (Web3) index fell 17.01%, while the Decentralized Finance (DeFi) index declined 19.23% despite total value locked remaining above $230 billion. The Digital Culture (META) index dropped 10.20%, extending its decline from 2025's brutal 74% loss. The Vinter Hashdex Risk Parity Momentum index fell 12.51%, its systematic approach unable to navigate the cross-currents of precious metals strength and crypto weakness.

Gold's Triumph: What It Means for Digital Gold

January's most instructive story lies in gold's dominance. The precious metal gained 13.30% in a single month—more than bitcoin delivered in all of 2024. This parabolic move, extending 2025's extraordinary 64% gain, demands an assessment of the "digital gold" narrative.

The data reveals a striking pattern: when geopolitical uncertainty peaks, institutional capital overwhelmingly prefers physical gold over its digital counterpart. January's gold surge was driven by the Greenland tariff crisis and NATO tensions, Federal Reserve independence concerns, central bank buying (China's 15th consecutive month of purchases), record ETF inflows into gold-backed products, and dollar weakness amid policy uncertainty.

Bitcoin's unique properties—programmability, transportability, divisibility, verifiable scarcity—remain intact. Yet 2026 opened with a demonstration that these properties alone cannot substitute for gold's 5,000-year track record when institutions seek shelter. The digital gold thesis isn't invalidated, but remains an emerging thesis. Bitcoin functions as a distinct asset class with crypto-specific value drivers, not merely a digital version of an existing store of value.

The Infrastructure Advantage: Building Through the Storm

Despite price weakness, crypto's institutional infrastructure continues to mature. The FOMC held rates steady at 3.50%-3.75% at its January 27-28 meeting, with markets pricing just two additional cuts in the second half of 2026. This higher-for-longer rate environment historically challenges risk assets, yet crypto's decreasing correlation with traditional markets—0.42 NCI-Nasdaq correlation observed in August 2025 versus 0.91 in March—suggests the asset class may increasingly chart its own course.

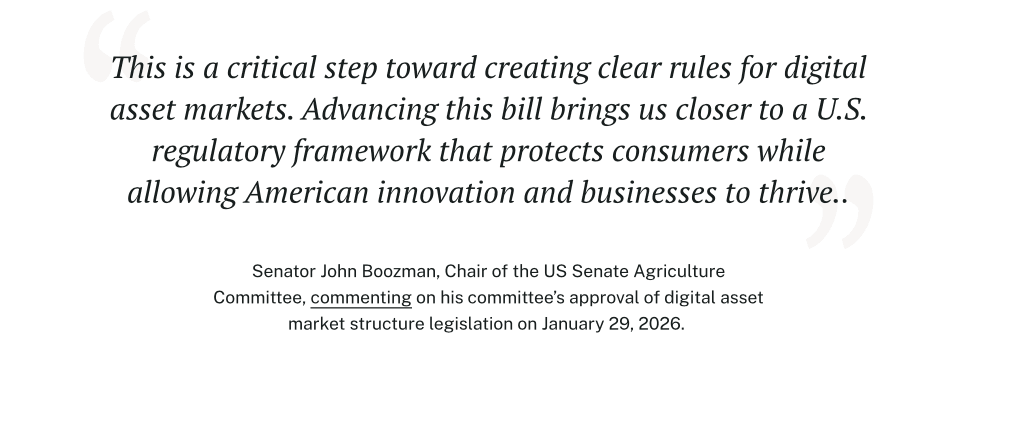

The regulatory framework established in 2025 remains operational: the GENIUS Act providing comprehensive stablecoin regulation, the SEC's 75-day ETF approval process enabling rapid product launches, Paul Atkins leading the SEC with zero enforcement actions in 2025, the Strategic Bitcoin Reserve institutionalizing Bitcoin as a sovereign reserve asset, and multiple crypto firms publicly traded with Gemini, Kraken, and Circle now on public markets.

Strategy (formerly MicroStrategy) continued accumulating, now holding over 672,000 BTC valued at approximately $60 billion. The US Strategic Bitcoin Reserve holds approximately 198,000 BTC. These structural holdings—representing committed, long-term capital—create supply constraints that persist regardless of short-term price movements.

Market Cap-Weighted Indices: Preservation Through Divergence

January validated once again the protective qualities of market cap-weighted exposure during challenging conditions. While individual sectors suffered double-digit declines—META down 10.20%, DeFi down 19.23%—the NCI's heavy Bitcoin allocation (approximately 75% weight) limited losses to 13.51%. This outperformance versus the most affected thematic indices compounds meaningfully over time.

The mathematics remain compelling: a portfolio down 13.51% requires 15.6% to recover; a portfolio down 19.23% requires 23.8%. Over multiple drawdown cycles, this difference in capital preservation proves decisive for long-term wealth creation.

Looking Ahead: Catalysts for Stabilization

As we enter February, multiple factors could shift market dynamics.

The January 27-28 FOMC decision and guidance will provide near-term direction. While the majority of the market is anticipating no rate change at the March FOMC, any dovish signals could benefit risk assets broadly. With the Greenland tariff "framework" still undefined, markets remain vulnerable to policy reversals. The administration's crypto-friendly stance—including digital asset market structure legislation working its way through Congress—offers potential positive catalysts.

Bitcoin testing support near $85,000 could attract accumulation from long-term holders. Exchange reserves remain at multi-year lows, suggesting limited selling pressure from existing holders. Gold's parabolic move may be unsustainable; any mean reversion could redirect safe-haven flows, potentially benefiting digital alternatives.

January will be remembered not for its modest losses but for the questions it raised about crypto's role in portfolios during periods of extreme uncertainty. Gold's dominance challenged convenient narratives, while regulatory and institutional infrastructure proved resilient despite price weakness. For investors with conviction in digital assets' long-term potential, the NCI's market cap-weighted methodology provided meaningful protection during a month when thematic bets suffered significantly worse outcomes.

The foundation built throughout 2025—regulatory frameworks, ETF vehicles, institutional custody, corporate accumulation—remains intact. What January demonstrated is that this foundation must weather periods when alternative safe havens capture market imagination. Patient capital that maintains systematic exposure through these periods positions itself for participation in crypto's eventual recovery.

Top Stories

Gold breaks $5,000 for first time in history

Gold prices surged past $5,000 per ounce on January 23, reaching $5,110 on January 26. The parabolic move was driven by geopolitical tensions (Greenland crisis, U.S.-NATO relations), Federal Reserve independence concerns, and record central bank purchases. Silver also set historic records, breaking $100 per ounce for the first time. The rally reinforces institutional preference for traditional tangible assets during periods of extreme uncertainty.

DOJ opens investigation into Jerome Powell

The Justice Department opened an investigation into Federal Reserve Chair Jerome Powell, ostensibly related to the Fed headquarters renovation project. Powell described the action as "blatant political pressure" and a "pretext." The Supreme Court heard arguments in Trump v. Cook regarding presidential power to fire Fed governors, with justices appearing skeptical of the administration's position. Republican senators pledged to block any Powell replacement until the investigation is resolved.

Greenland crisis rattles markets, but Trump backs down

Threats of 10% tariffs on eight European countries over Greenland caused the worst single-day decline since October 2025, with the S&P 500 falling more than 2% on January 20. However, Trump reversed course after meeting with NATO Secretary-General at Davos, claiming a "framework of a deal."

__________________________

NCIQ: Effective January 20, 2026, the Fund changed its name from Hashdex Nasdaq Crypto Index US ETF (NCIQ) to Hashdex Nasdaq CME Crypto Index ETF (NCIQ)

Effective January 20, 2026, the index changed its name from Nasdaq Crypto Index (NCI) to Nasdaq CME Crypto™ Index.

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.